Can Storm Damage Be Covered by Insurance?

In Florida, roof damage from storms may qualify for insurance coverage, but that depends on your policy specifics, the storm type, and your roof’s condition before the weather hit. Knowing how storm-related roof insurance works in Florida—including common coverage and reasons claims get denied—can make the difference between a denied payout and a fair settlement.

Key Takeaways

- Most standard homeowners insurance in Florida includes coverage for roof damage caused by wind, hail, falling debris, and rainwater entry linked to storm-related roof openings.

- Damage from flooding or long-term neglect, including general aging or overlooked maintenance, is usually not included unless added through a separate policy.

- Take photos quickly, make short-term fixes to stop more damage, and connect with your insurer early. These steps strengthen your claim.

- Claims from hurricanes often involve a separate, higher deductible. Insurers may also require confirmation that the storm received a name from a national authority.

- A roofing inspection from a licensed contractor helps your case. Contractors often find issues insurance adjusters miss, improving your chance at fair compensation.

Understanding Insurance Coverage for Storm Damage

Most homeowners’ insurance policies do cover storm damage—but the details matter. For example, understanding if a Chubb storm damage to roof covered by insurance claim will be approved requires reviewing policy terms closely. Coverage typically depends on the type of storm, the kind of damage, and how well the roof was maintained before the storm hit. We’ve seen too many neighbors learn the hard way that not all insurance claims go through without a hitch.

What’s Typically Covered Under Homeowners Insurance

While every policy is different, standard homeowners’ insurance often includes protection for sudden, accidental storm damage. Here’s what’s generally covered:

- Wind and hail: Damage to shingles, flashing, or skylights caused by high winds or hail strikes is usually included.

- Falling debris: If a branch punches through your roof during a windstorm, repairs or replacement may be covered.

- Rainwater after wind damage: If rain enters through a hole created by storm-force winds, insurers typically classify this as secondary damage and may cover it.

- Lightning strikes: Fires or structural damage from lightning are almost always part of standard coverage.

Review your policy’s declarations page to see what’s included under storm coverage. If you’ve experienced hurricane-force winds, you’ll want to know exactly how your insurer defines storm versus flood damage.

Common Exclusions You Should Know

Some storm-related issues fall outside the scope of standard policies. For example:

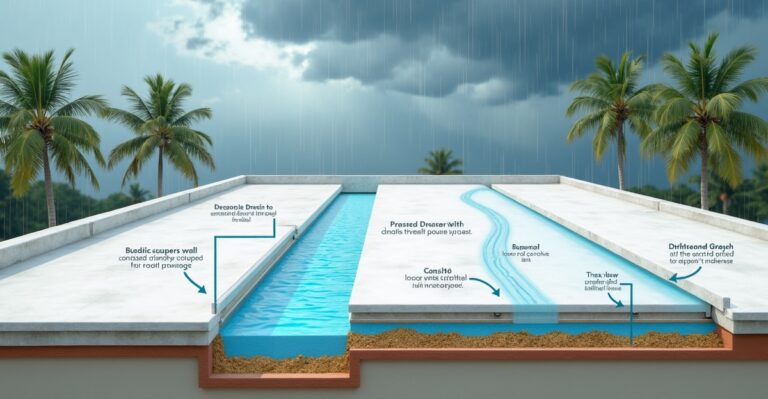

- Flood damage: Water rising from the ground up—whether from storm surge or street flooding—often requires separate flood insurance.

- Neglect or poor maintenance: Insurers may deny claims if the roof was already in poor shape.

- Wear and tear: Damage from long-term aging, corrosion, or gradual leaks usually isn’t covered unless a storm directly caused the issue.

If your shingles were already curling or cracked before the storm rolled in, it could become a grey area. The insurance adjuster may argue the problem existed beforehand. That’s why routine roof inspections are such a valuable investment.

What to Do Immediately After the Storm

Act quickly and smartly after storm damage. It helps protect both your home and your insurance claim.

- Document everything: Take clear photos of the damage from multiple angles.

- Prevent further damage: Tarp any exposed areas. Insurers expect reasonable action on your part to limit loss.

- Contact your insurance provider: Start the claims process and ask about their specific documentation needs.

- Call a trusted roofing contractor: A professional assessment strengthens your claim and ensures nothing gets missed. Teams like ours can even help you understand whether it’s best to repair or replace the roof.

Keep receipts for emergency repairs or materials—your insurer may reimburse you later.

How Hurricane Damage Is Handled Differently

In Florida, hurricane damage can fall under a different deductible than windstorm damage. That deductible tends to be higher and is based on a percentage of your insured home value. According to our experience and industry standards, these policies usually kick in only after the National Weather Service declares the event a named storm.

Roofers who understand hurricane claims, like our team, can make a big difference. We guide homeowners through the process based on what’s confidently covered. For more information on how this plays out locally, check out this article on how hurricanes damage shingle roofs in Florida.

How We Support Insurance Claim Roof Repairs

We work closely with homeowners to assess storm-related roof issues and provide detailed damage reports. From there, we offer practical repair solutions that align with your insurance adjuster’s requirements. Our team has years of experience coordinating with both large insurers and regional carriers, so we understand how to communicate effectively throughout the claims process.

Whether you need full replacement or a smaller repair, we’re ready to help. If you haven’t yet filed a claim or need help assessing next steps, our storm damage repair service is here to support you from inspection through final cleanup.

Remember, prompt action after the storm can make or break a successful insurance outcome. Sometimes even minor roof issues get worse quickly. That’s why we always encourage a professional inspection—just to be safe, and to avoid surprise costs down the line.

Types of Storm Damage Typically Covered by Insurance

Common Types of Storm-Related Roof Damage Covered

Most homeowners looking into roof storm damage insurance Florida policies will find that coverage includes storm damage, but protection varies depending on the source of the damage and your specific policy. We’ve handled repairs after countless Florida storms and know that coverage usually includes damage directly caused by wind, hail, fallen trees, and water intrusion tied to roof openings created by the storm.

Here are the types of storm damage that are often covered:

- Wind damage: High winds can lift, crack, or completely tear off shingles. In many cases, insurance will pay to replace affected areas or, if widespread, the whole roof.

- Hail damage: Though not as frequent along the coast, hail can bruise shingles or dent metal roofing. Even minor hail impacts can shorten a roof’s lifespan if left unaddressed.

- Falling debris: Trees or limbs crashing onto your roof during a storm can rupture decking and create serious leaks. Most standard policies include this type of structural damage.

- Water damage linked to wind: If heavy winds blow rain into your attic through compromised areas of the roof, insurance typically covers resulting water damage if it’s traced back to the storm.

That said, not all water damage is covered. For example, flooding due to rising groundwater usually falls under a separate flood policy.

We recommend checking your deductible specific to hurricanes or windstorms—many Florida policies include higher deductibles for named storms. It’s also worth reviewing how actual cash value (ACV) differs from replacement cost value (RCV). ACV deducts for depreciation, while RCV offers coverage for the full cost to restore your roof without subtracting for age.

Cases and Exceptions That May Not Be Covered

Sometimes insurance won’t cover storm damage even if a weather event occurred. Knowing these exceptions upfront helps us advise clients on both claims and long-term steps for protecting their property.

Insurers may deny coverage for:

- Neglected maintenance: If a storm damages roofing that was already in poor shape—such as loose flashing or degraded underlayment—the claim might be rejected for lack of upkeep.

- Old age or wear: Storm damage might not be covered if the roof has reached the end of its lifespan. That’s one reason why staying ahead of repairs is so vital.

- Previous damage: Insurers often send adjusters to determine if the incident caused new damage or worsened something preexisting. If the damage wasn’t directly related to the storm, it may not qualify.

- Improper installation: Damage can also go uncovered if the roof wasn’t built to standard codes or if there were known defects during installation.

If your claim is denied for any of the above, we’re here to support. Our inspection reports often help provide a stronger case for reevaluation. In some cases, we can suggest more affordable options such as repair instead of replacement to reduce out-of-pocket costs.

If you’re unsure whether to file at all, especially for smaller issues, learn about roof repair costs in Florida first to weigh your options.

Timing also matters. Prompt action strengthens most claims. That’s why we respond quickly with assessments after each major storm and help homeowners gather the evidence they need.

If your area was recently hit by a named storm, a thorough pre-claim inspection is a smart move. Our storm damage repair team can determine whether you’ve got hidden structural or water issues—even if they’re not yet visible inside your home.

In coastal counties especially, strong winds and driving rain can compromise even newer roofs. Learn how that happens in our quick guide on how hurricanes damage shingle roofs in Florida.

Storm season is never easy, but working with local experts helps simplify each step. We know what insurance adjusters typically look for and how to document storm impact clearly. By staying proactive with roof care and cautious with every claim, we help homeowners protect their coverage now and down the line.

Steps to Take After Your Roof Is Damaged by a Storm

Act Quickly but Safely

After a storm, the most important thing is to make sure everyone’s safe. Once the weather clears, take a walk around the outside of your home to assess the situation. If shingles are in the yard or metal flashing is missing, it’s a strong sign your roof took a hit. Avoid climbing onto the roof yourself—let trained professionals handle that. Document visible damage with clear photos. These will be valuable for your claim later.

If you can, place buckets or plastic under leaks inside the home to catch water. The goal here is to prevent more damage while also keeping your home as dry as possible. Don’t wait to call someone—delaying repairs can make things worse and could complicate your insurance claim.

Contact Your Insurance and Professional Help

The next step is to notify your insurance company. Provide the details and photos you’ve collected. Ask them what else is needed for the claims process. They’ll likely send an adjuster out to inspect the damage. Keep records of your conversations and take note of any claim number they assign you.

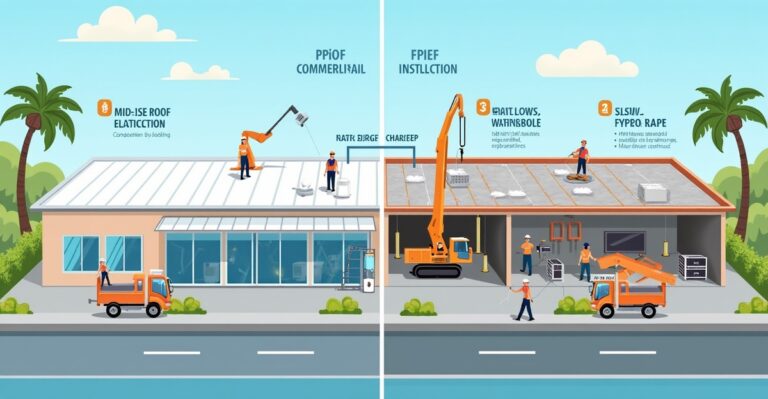

While insurance is being sorted out, we recommend scheduling an inspection with a trusted roofing contractor. A trained eye can find hidden issues that an adjuster might miss. In many cases, we work directly with insurance adjusters to make sure nothing important is overlooked during the assessment.

If the damage poses an immediate risk—like wide-open sections of roof or fallen debris—we offer quick-turnaround storm damage repair to help secure your home until full repairs are scheduled. A temporary fix might be all you need until your claim processes.

To help you stay prepared, here’s a simple checklist to follow after storm damage occurs:

- Check for downed power lines or flood hazards before going outside.

- Take wide and close-up photos of roof, soffits, fascia, and gutters.

- Safely collect any pieces of shingles or flashing from the ground.

- Write down the date, time, and details of the storm event.

- Contact your insurance with collected documentation.

- Schedule a professional inspection even if the damage seems minor.

Even smaller issues like damaged fascia or cracked vents can lead to bigger problems down the road. Catching and documenting everything early makes the claim more accurate and the repairs more effective.

For a deeper look at post-storm issues, this breakdown on how hurricanes damage shingle roofs helps explain what to watch for in Florida’s climate.

Once we’ve assessed the damage, we’ll go over your options—including whether a roof repair is enough or replacement makes more sense. Either way, we’re here to protect your home and make the recovery process smooth.

Steps to Take After Storm Damage for Insurance Claims

Initial Safety and Damage Assessment

Before we think about insurance paperwork, safety comes first. After the storm passes, wait until conditions are safe, then do a basic visual check from the ground. Look for missing shingles, damaged flashing, bent gutters, or fallen tree limbs. If there’s water coming in, catch it with buckets and cover what you can with tarps from the inside.

Don’t climb onto the roof—that’s risky and can make things worse. Instead, take photos and videos from the ground. Document everything: roof damage, structural issues, water inside the home, and anything else affected. The more evidence we have, the smoother our claim will go.

In some cases, it helps to work directly with a professional roofer for a more accurate picture of the damage. We often assist with assessments related to insurance claims. If we spot serious shingle uplift or moisture infiltration, we’ll prepare a written report backed with photos.

Filing Your Insurance Claim

Getting the claim process started shouldn’t be delayed. Most insurance policies require that storm damage be reported quickly. Here’s what we recommend doing right away:

- Review the homeowners insurance policy so we know what’s covered and what’s not

- Notify the insurance company, preferably with a detailed description and initial photos

- Ask for a claim number and keep records of every conversation and email

- Schedule their adjuster’s inspection as soon as possible

Some insurers may also request a contractor’s written estimate. We can step in here—we provide honest evaluations with repair or replacement details so insurance adjusters have the full scope. In cases of wind uplift or hail impact, it’s common that the adjuster may miss smaller but critical issues like sublayer cracking. Involving a licensed roofer ensures the claim reflects the actual conditions, not just what’s easy to see from the street.

Once we document the damage, we’ll walk you through whether you can address it with a localized roof repair, or if a full replacement might make more financial and structural sense. Insurance typically determines its payout based on both cost and material life expectancy.

If you’re unsure whether a replacement might be the better route, check out these warning signs your roof may need replacement in Florida.

Working With the Adjuster and a Roofing Professional

Being present during the insurance adjuster’s visit can make a big difference. We recommend having a licensed roofer with you during the inspection. This helps ensure minor—but costly—damage is properly documented.

Our team has walked properties with adjusters countless times. During these joint evaluations, we point out less obvious signs of damage: punctured underlayment, granule loss, cracked vent boots. We use this approach to advocate for the property owner’s best interest so nothing gets left off the coverage.

In our experience, local contractors who understand Florida’s weather patterns—especially wind-driven rain, shingle uplift, and hurricane stress—are better equipped to explain storm impact. Adjusters might miss clues if they’re not familiar with regional storm behavior. You can learn more about those risks in this blog on how hurricanes damage shingle roofs.

Next Steps: Repairs, Replacements, and Timing

Once the claim is approved, timing matters. Materials may need to be ordered, and if a storm just rolled through the area, crews are often busy. Still, we urge homeowners to book their work promptly before things worsen—especially if temporary tarping is all that’s holding off the rain.

In some cases, property owners ask if repairs could get the job done, rather than entirely replacing the roof—which often depends on the shingle roof replacement cost Daytona residents typically face. There are definitely cases where repairing instead of replacing is cost-efficient and smart. But in other situations, the insurance payout makes a full replacement financially logical—especially if the roof is nearing the end of its typical lifespan.

For storm-related work, we offer expert storm damage repair services that address both minor and major issues, including structural decking, flashing seams, and soffit rot. If the damage is extensive and your insurer approves a full roof replacement, we can handle the full install process with no surprises along the way.

Not sure if now’s the right time to replace? We share regional insight in our guide on best times to replace a roof in Florida, helping you plan for both budget and weather.

No matter where you are in the claims process, we’re here to make it less stressful. If you’re ready for an inspection or need help understanding your next steps, the team at Pyramid Roofing is ready to support you from your first call to the final shingle.

How to File a Storm Damage Insurance Claim

Once storm damage hits your roof, time becomes critical. Quick action can help minimize further issues and improve the success of your insurance claim. Here’s how we recommend handling the process with clarity and confidence.

Steps to File a Claim Successfully

To give your claim the best chance of being approved, follow these key steps:

- Document the damage thoroughly. Use your phone or camera to take clear, date-stamped photos of any visible issues—missing shingles, broken tiles, leaks, or dents in flashing.

- Review your insurance policy. Know what’s covered and where limitations might exist. Focus on the dwelling coverage and “acts of nature” sections.

- Contact a roofing professional. A qualified inspection can verify the damage, uncover hidden problems, and support your claim. We highly recommend having a licensed contractor walk through the findings with you.

- File the claim with your insurance provider. Provide all documentation, including contractor reports and photos.

- Schedule an insurance adjuster visit. When the adjuster comes, consider having your roofer present to explain damage specifics and ensure nothing’s missed.

Working with a trusted local contractor can improve how smoothly this process goes. If you’re unsure how much your claim may cover, our team offers expert support during this stage. We’re experienced in both full replacements and roof repairs following wind and hail storms.

Insurance claims can move slowly—expect some back and forth. Stay organized, keep copies of emails, records of phone calls, and written estimates. The more detailed your timeline is, the better.

In Florida, storm damage might be hidden. Just because there’s no leak today doesn’t mean your roof is safe for tomorrow. This is especially true after hurricane season. Learn more from our article on how hurricanes damage shingle roofs.

If your claim is denied or undervalued, you’re not alone. It’s okay to ask for a second inspection or consult with a contractor who’s familiar with claim disputes. We’ve helped many homeowners navigate those tough conversations and get fair coverage.

We’re here to support families, property managers, and community leaders looking to protect their homes after a storm. Don’t let paperwork or uncertainty delay action. We’re more than ready to help you file a strong claim or connect with our storm damage repair specialists for a thorough inspection.

What to Do If Insurance Denies Your Storm Damage Claim

Facing a denied roof insurance claim after a storm can feel like hitting a wall, especially when you’re counting on that help to restore your home. We’ve seen it happen to good people who did everything right—or thought they did. But there’s still a path forward. You’re not out of options.

Steps to Take After a Denied Claim

If your storm damage claim has been denied, don’t panic. Follow these steps to reassess and respond:

- Review the denial letter: Insurance companies are required to explain why they’re denying a claim. Scrutinize the language closely. Look for specific policy exclusions or wording you may not agree with.

- Request a second inspection: Sometimes a second set of eyes makes all the difference. You can ask the insurance company for another inspection, or bring in an independent roofing contractor who specializes in storm damage.

- Document everything: Take clear photos of the damage, jot down dates of the storm and inspections, keep all receipts and communications. This evidence will help support your case if you challenge the denial.

- Get a licensed roofing contractor’s report: A detailed inspection report from a professional, especially a contractor with local storm experience, can reveal issues an adjuster overlooked. If you haven’t already, this is a good time to connect with our team for a full assessment.

- Consult a public adjuster: These professionals work on your behalf, not the insurance company’s. They’ll review your policy, reinspect the damage, and can negotiate for a fairer outcome.

- Appeal the decision: Most providers have a formal appeal process. We recommend including the contractor’s report, photographs, and any relevant support documents.

- Consider legal action as a last resort: If the insurer is acting in bad faith, a property claims attorney may be able to step in. This should follow efforts to negotiate or appeal.

Some homeowners also ask, can my damaged roof be repaired rather than replaced? That’s where an honest roofer makes a big difference. If a full replacement isn’t necessary, we’ll say so—and back it up with photos and a written explanation you can submit to your insurance provider.

We also recommend checking your policy’s language closely. Denied claims often come down to fine print like “maintenance neglect” or “wear and tear,” even after major storm events. But if a storm clearly caused missing shingles, punctures, or leaks, that’s damage—not deterioration.

We’ve worked with many homeowners after hurricanes, and it’s true: some adjusters miss wind-lifted shingles, separated flashing, and saturated underlayment. These might not be obvious at first glance but still lead to serious issues like mold or wood rot if untreated. That’s why hiring a licensed contractor familiar with how hurricanes damage shingle roofs in Florida can be a game-changer in overturning a denial.

If there’s extensive visible damage or underlying water intrusion, and the insurer refuses to budge, we can also explore roof replacement options and advise on supplemental claims or financing if needed.

Denied claims don’t have to be final. With the right partner and some persistence, we can help you make a strong case—or find alternatives that protect your home moving forward.